The AI, Crypto, and other Buzzwords Revolution

In today’s world, where everyone is constantly fighting for your attention and coming up with new fancy buzzwords to make it seem like you’re missing out, it’s hard to find a place you can trust to inform yourself.

We at Scale Up aim to be this place. So let’s get on with it.

How AI is Revolutionizing Finance in Canada

AI is transforming the financial landscape in Canada, making it easier for institutions and individual users to manage money, invest, and plan for the future. Here’s how:

AI for Budgeting and Personal Finance

AI-powered tools are helping Canadians manage their finances by providing personalized insights, automating savings, and simplifying budgeting. These tools analyze spending patterns, predict future expenses, and offer actionable advice.

Wealthsimple (Mostly for investing your money):

Wealthsimple is a leading Canadian fintech company that offers AI-powered robo-advisory services. Its platform creates personalized investment portfolios based on your risk tolerance and financial goals. Wealthsimple also offers a Wealthsimple Cash account, which analyzes your spending and suggests ways to save money.Credit Karma (Mostly for tracking your expenses):

Credit Karma provides free credit scores and financial insights using AI. It helps Canadians monitor their credit health, detect fraud, and get personalized credit card and loan recommendations. They track your spending, categorize expenses, and create budgets. It also sends alerts for bill payments and provides tips to save money.DeepSeek, Co-Pilot (or any other Large Language Model)

LLMs can be used to help you brainstorm ideas, savings goals, and educate yourself on financial literacy. Ask them the questions you would like to ask a financial professional (and don’t forget to ask for the sources of that information too)!

AI for Crypto Trends and Trading

AI plays a significant role in crypto by analyzing market trends, predicting price movements, and automating trading strategies. Canadians are increasingly using AI-powered tools to navigate the volatile crypto market.

Wealthsimple Crypto:

Wealthsimple Crypto is a user-friendly platform that allows Canadians to buy, sell, and hold cryptocurrencies like Bitcoin and Ethereum. While it doesn’t use AI directly for trading, its integration with Wealthsimple’s robo-advisory services provides a seamless experience for users who want to diversify their portfolios with crypto.CoinTracker:

CoinTracker is an AI-powered crypto tax calculator that helps Canadians track their crypto transactions and generate tax reports that are compliant with CRA regulations.

AI for Institutional Finance

This section is not important for retail users, but it shows how this technology is probably here to stay and how big institutions are adopting it. Canadian banks and financial institutions leverage AI to improve customer service, detect fraud, and optimize investment strategies. Other big names are likely using it, too, but I found these most relevant.

RBC (Royal Bank of Canada): Uses AI for fraud detection and personalized financial advice through its NOMI Insights feature.

TD Bank and BMO: AI analyzes customer data and offers tailored product recommendations.

ETFs: A Smart Way to Diversify Your Portfolio

Exchange-traded funds (ETFs) are one of the best ways for Canadians to diversify their investments and reduce risk. Here’s why ETFs are a great option, especially when managed through platforms like Wealthsimple:

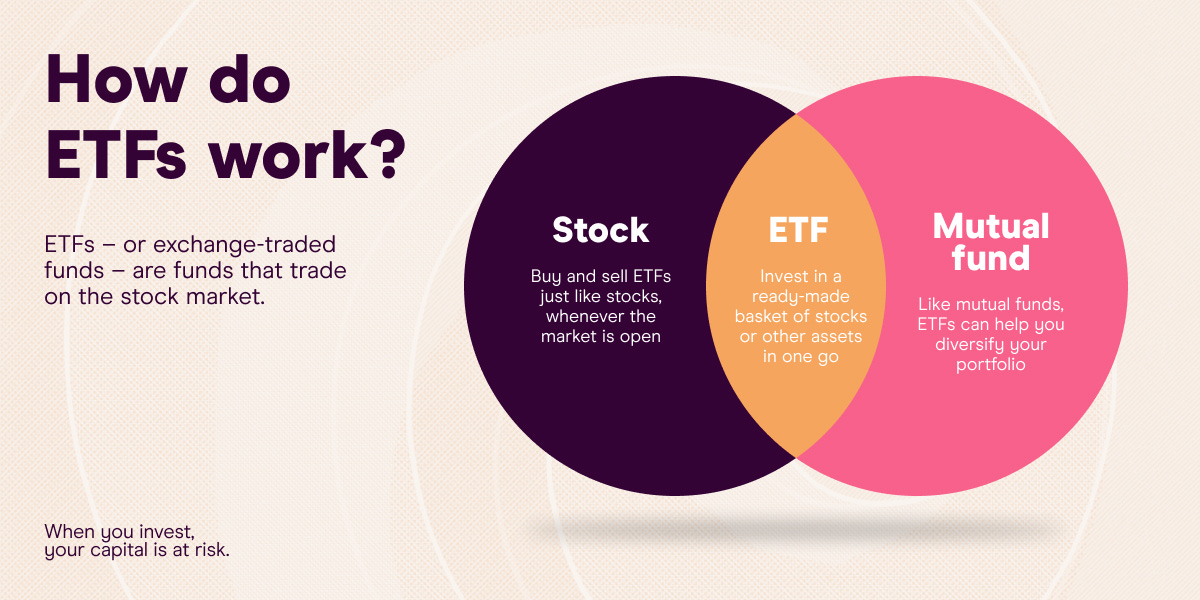

What Are ETFs?

ETFs are investment funds that trade on stock exchanges, similar to individual stocks. They hold a basket of assets, such as stocks, bonds, or commodities, and provide exposure to various markets and sectors. It limits profits but also limits losses instead of investing in individual stocks.

Benefits of ETFs

Diversification:

ETFs allow you to invest in hundreds or even thousands of assets with a single purchase, reducing the risk of investing all your money in one stock or sector.Low Costs:

ETFs typically have lower management fees than mutual funds, making them a cost-effective option for long-term investors.Flexibility:

ETFs can be bought and sold throughout the trading day, offering more flexibility than mutual funds.Transparency:

ETFs disclose their holdings daily, so you always know what you invest in.

How Wealthsimple Makes ETFs Accessible

Wealthsimple’s robo-advisor platform uses AI to create and manage ETF-based portfolios tailored to your financial goals and risk tolerance. Here’s how it works:

Personalized Portfolios:

Wealthsimple builds a diversified portfolio of ETFs based on your investment preferences.Automatic Rebalancing:

The platform uses AI to automatically rebalance your portfolio, ensuring it stays aligned with your goals.Low Fees:

Wealthsimple charges a low management fee, making it an affordable option for Canadians.Socially Responsible Investing (SRI):

Wealthsimple offers SRI portfolios focusing on companies with strong environmental, social, and governance (ESG) practices.

I would approach ETFs by observing global trends and identifying industries that could benefit from them. For example, AI is being adopted everywhere, but we might not have all the energy requirements for its widespread adoption. So, governments might be forced to invest in energy alternatives that produce a lot of output with minimal pollution, such as nuclear power. I would then look up and invest in ETFs that represent the market.

Specific Apps to Explore

Here’s a quick recap of the apps and platforms mentioned:

Wealthsimple:

Robo-advisory services for ETFs and crypto.

Wealthsimple Cash for budgeting and saving.

Credit Karma:

Free credit scores and financial insights.

AI-powered budgeting and expense tracking.

CoinTracker:

Crypto tax calculator for Canadians.

As mentioned in previous newsletters, Kraken.com is my main crypto exchange of choice, and you can check out this post to learn more. So, it is a great contender for diversifying your money and investing directly in crypto. But if you want a more all-encompassing app where you can invest in crypto, stocks, ETFs, retirement, TFSAs, etc., then Wealthsimple is the way to go.

If you join the app through this link and use the promotional code PHDCZQ, you’ll receive $25 with your first deposit.

Remember to invest safely and do your own research before putting your money anywhere on the internet!